Scottish Tax Changes 2025/26: What Small Business Owners Need to Know

As a small business owner in Scotland, staying on top of tax updates is essential, not just for

compliance, but for planning ahead and keeping your business financially healthy.

The 2025/26 tax year introduces a number of important changes, especially for sole traders,

company directors, and small limited companies. In this post, we’ll break down what’s

changing and how you can prepare.

Note: Always seek tailored advice from an accountant or tax adviser, especially if your

Circumstances are more complex.

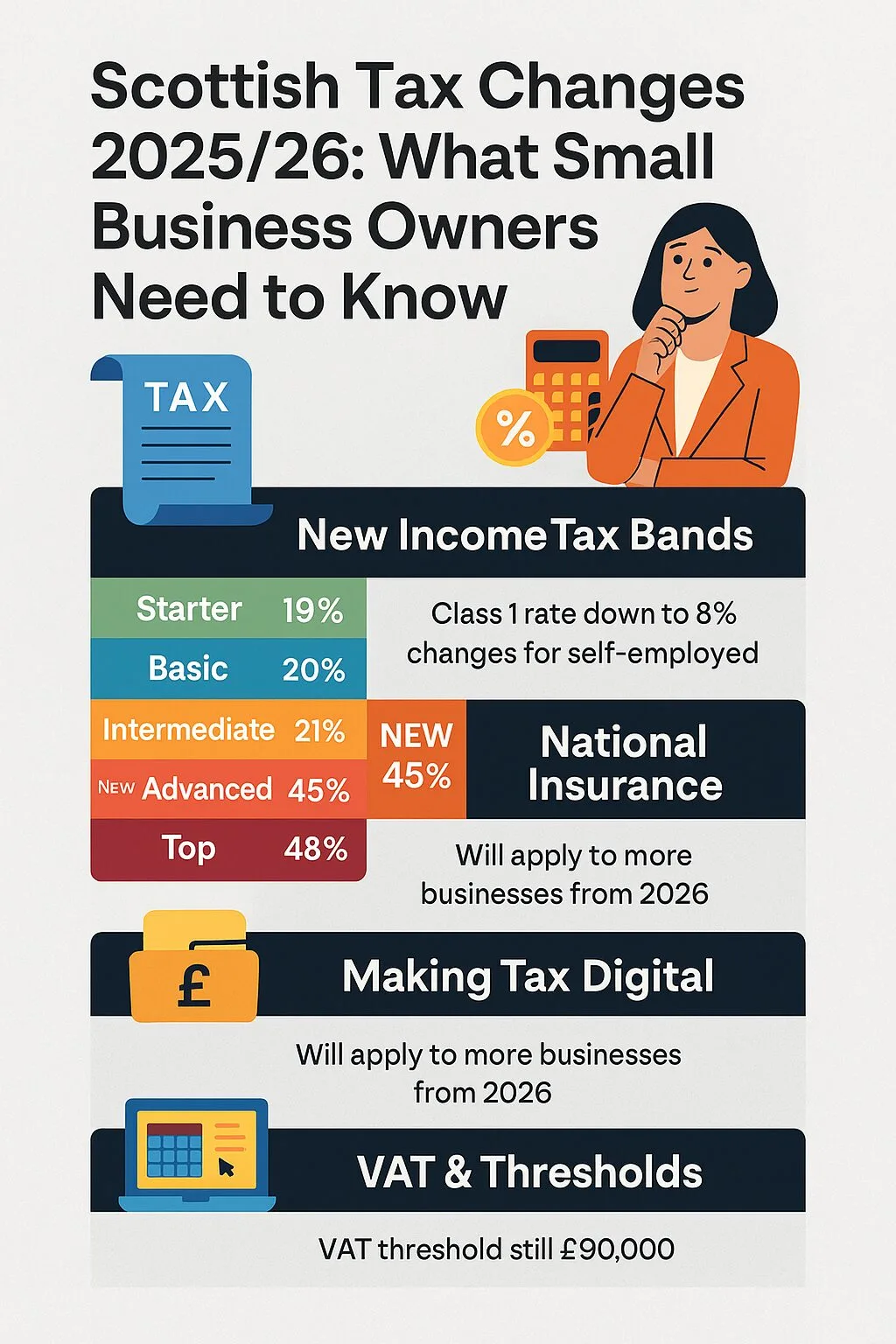

1. New Scottish Income Tax Bands for 2025/26

The Scottish Government has adjusted tax bands and rates again this year. Here's a simplified

breakdown for earned income (e.g. salary, self-employed profits):

Band Rate Income Range

Starter 19% £12,571 – £14,876

Basic 20% £14,877 – £26,561

Intermediate 21% £26,562 – £43,662

Higher 42% £43,663 – £75,000

Advanced (new) 45% £75,001 – £125,140

Top 48% £125,141+

If you’re a sole trader, your profits will be taxed according to these bands (after your

personal allowance).

2. What If You’re a Company Director?

If you’re the director of a limited company, you may pay yourself through a mix of salary and

dividends. It’s more tax-efficient, but you’ll still need to be mindful of:

- PAYE thresholds for salaries

- Dividend tax rates, which apply UK-wide

- Corporation Tax, which remains at 25% for profits above £50,000 (though smaller

Companies benefit from marginal relief.)

It’s wise to reassess your salary/dividend mix annually based on the latest tax bands.

3. National Insurance Update

For employee earnings, National Insurance (NI) has been reduced in the UK from previous

years:

- Class 1 employee rate is now 8% (for earnings above £12,570)

- Class 2 (self-employed flat rate) is being scrapped from April 2025

- Class 4 (self-employed profits) is dropping to 6%

4. Making Tax Digital (MTD) for Income Tax

From April 2026, MTD for Income Tax will become mandatory for self-employed

individuals and landlords earning over £50,000, with the threshold dropping to £30,000 in

2027. While not a 2025 change, it’s essential to start preparing now.

Using cloud accounting software like Xero, FreeAgent, or QuickBooks can make this

transition smoother.

5. VAT & Thresholds

The VAT registration threshold remains at £90,000 for 2025/26. If your annual turnover

exceeds this, you must register for VAT. Staying just below this limit? Keep a close eye on

monthly turnover to avoid a surprise registration.

6. What You Can Do Now

- Speak to your accountant about tax planning

- Review your salary/dividend mix (if a director)

- Move to cloud-based bookkeeping tools

- Track your earnings against thresholds

- Budget for changes to income and NI

How Clyde Offices Can Help

Our virtual assistant service can take care of admin, invoicing, and email follow-ups—so

you can focus on running your business. Our telephone answering service ensures you never

miss calls from clients or HMRC. And with a virtual business address, you’ll always have a

professional front, even from home.